Shares in South Korean shipping giant Hanjin jumped today after the indebted company announced plans to sell some of its major businesses.

A court filing said that the firm, which recently asked for bankruptcy protection, had received legal approval to seek buyers for its assets in order to pay back creditors which are lining up claims. It will receive letters of intent by 28 October.

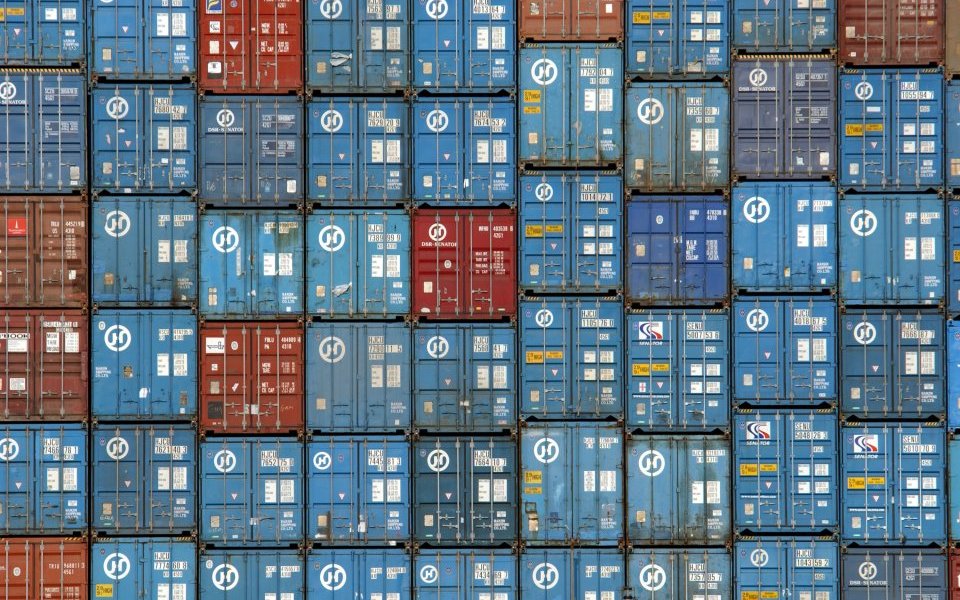

A spokesman for the Seoul Central District Court overseeing Hanjin’s receivership told Reuters today that assets currently set to be put up for sale include the entire operations of Hanjin’s US to Asia routes such as manpower systems, five container ships, and 10 overseas businesses.

He declined to comment on the potential price or interested parties for the assets.

Hopes for a successful asset sale helped Hanjin’s shares close up 30 per cent, reversing some of the losses it has suffered since the firm filed for receivership in a Seoul Court on 31 August.

Hanjin is the first major shipping operator to be dragged down by the global industry’s problem with overcapacity. It debts stood at six trillion won (£4bn) at the end of June.

Its collapse has resulted in billions of pounds worth of cargo being effectively stranded at sea and been likened to the Lehman credit freeze in terms of its effect on the industry.

More than half of Hanjin’s 97 container ships and 44 bulk carriers are blocking from docking, and four have been seized.